Instructions For Form 8863

Instructions For Form 8863 - Web Feb 17 2023 nbsp 0183 32 Form 8863 is used by individuals to figure and claim education credits Hope Credit Lifetime Learning Credit etc Use Form 8863 to figure and claim your education credits which are based on qualified education expenses paid to an eligible postsecondary educational institution Web Form 8863 Department of the Treasury Internal Revenue Service Education Credits American Opportunity and Lifetime Learning Credits Attach to Form 1040 or 1040 SR Go to www irs gov Form8863 for instructions and the latest information OMB No 1545 0074 2022 Attachment Sequence No 50 Name s shown on return Your social security Web Dec 28 2022 nbsp 0183 32 Fill PDF Online Download PDF These instructions for IRS Form 8863 Education Credits American Opportunity and Lifetime Learning Credits explain how to utilize this form when claiming costs for post secondary schooling Each form includes the space for two dependents

In case you are searching for a simple and efficient way to increase your performance, look no more than printable templates. These time-saving tools are simple and free to utilize, offering a variety of advantages that can assist you get more done in less time.

Instructions For Form 8863

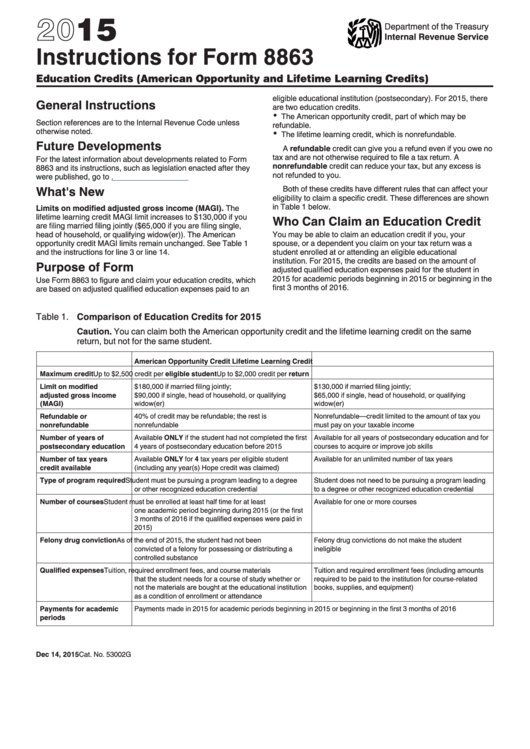

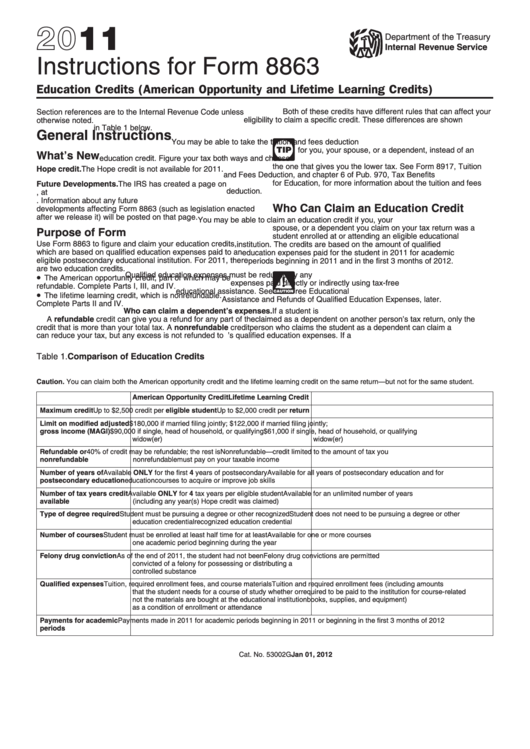

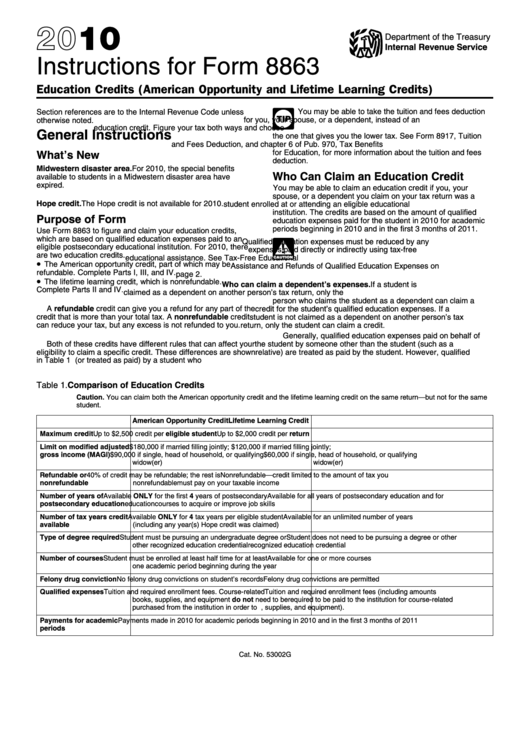

Instructions For Form 8863 Education Credits American Opportunity

Instructions For Form 8863 Education Credits American Opportunity

Instructions For Form 8863 Education Credits American Opportunity

Instructions For Form 8863 To start with, printable templates can help you remain organized. By offering a clear structure for your tasks, order of business, and schedules, printable design templates make it much easier to keep everything in order. You'll never need to fret about missing out on due dates or forgetting essential jobs again. Using printable design templates can help you conserve time. By eliminating the need to produce new documents from scratch each time you require to complete a job or plan an event, you can concentrate on the work itself, instead of the documents. Plus, numerous design templates are customizable, allowing you to individualize them to fit your requirements. In addition to saving time and staying organized, utilizing printable templates can likewise assist you stay motivated. Seeing your progress on paper can be a powerful motivator, encouraging you to keep working towards your goals even when things get tough. In general, printable design templates are a fantastic way to boost your efficiency without breaking the bank. So why not provide a try today and begin accomplishing more in less time?

Credit Limit Worksheet For Form 8863 Dev onallcylinders

Credit limit worksheet for form 8863 dev onallcylinders

Credit limit worksheet for form 8863 dev onallcylinders

Web IRS Form 8863 Instructions Tips for IRS Form 8863 What is Form 8863 Tax Form 8863 is a two page IRS document used to claim education credits The education credits are designed to offset updated for current information Tax Form 8863 American Opportunity Credit AOTC What is the American Opportunity Tax Credit

Web LLC you or your dependent must be or have been a student who is or was enrolled in at least one course during the tax year AND have a modified adjusted gross income below the threshold for 2020 the threshold is 69 000 or 139 000 for joint filers Find out more about what education expenses qualify Form 8863 Instructions

IRS Form 8863 Instructions

Irs form 8863 instructions

Irs form 8863 instructions

Instructions For Form 8863 Education Credits American Opportunity

Instructions for form 8863 education credits american opportunity

Instructions for form 8863 education credits american opportunity

Free printable templates can be a powerful tool for enhancing productivity and accomplishing your goals. By choosing the right design templates, incorporating them into your routine, and individualizing them as needed, you can enhance your day-to-day jobs and make the most of your time. Why not provide it a shot and see how it works for you?

Web Jul 18 2023 nbsp 0183 32 This tax credit is only available to taxpayers with a 2022 MAGI below 90 000 if filing individually or 180 000 if married filing jointly TurboTax Tip Complete Form 8863 and attach it to your tax return to claim the American Opportunity Credit or the Lifetime Learning Credit

Web Feb 4 2023 nbsp 0183 32 Form 8863 Basics For those who decide to increase their human capital by enrolling in post secondary education courses there are two targeted tax credits the American Opportunity Credit AOC part of which may be refundable and the Lifetime Learning Credit LLC which is not refundable