Form 940 2024 Fillable

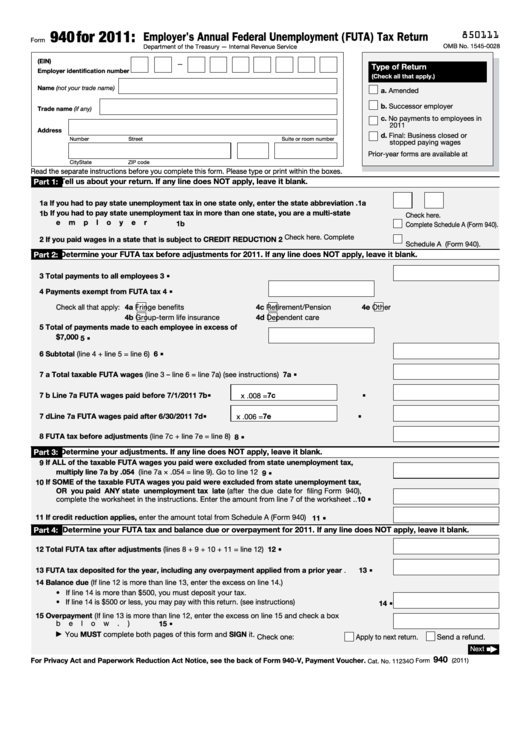

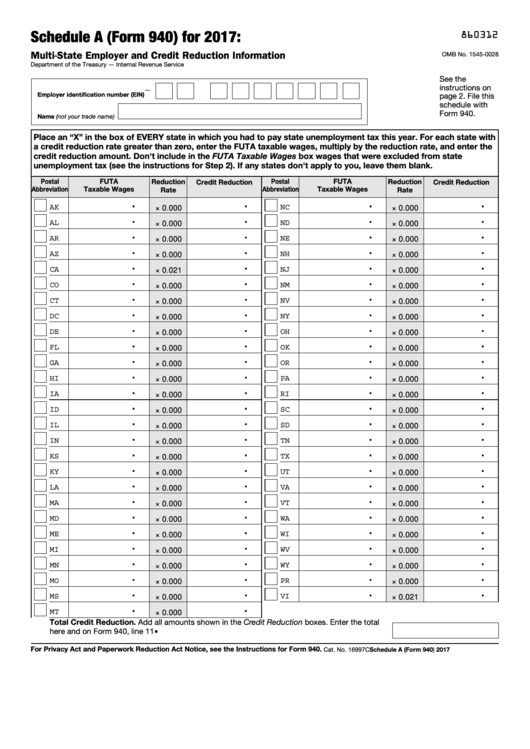

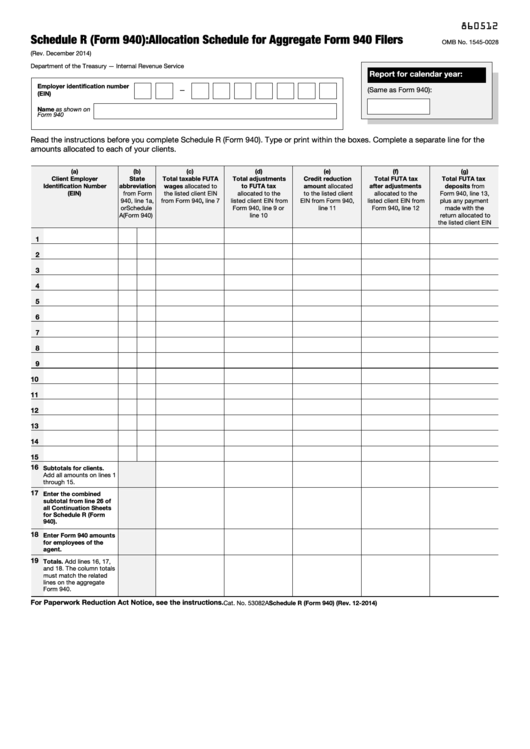

Form 940 2024 Fillable - WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season Form 940 Employer s Annual Federal Unemployment Tax Return Schedule A Form 940 Multi State Employer and Credit Reduction Information Schedule R Form 940 Allocation Schedule for Aggregate Form 940 Filers PDF Form 941 Employer s Quarterly Federal Tax Return Schedule B Form 941 Employer s Record of Federal Tax Liability Form W 4R 2024 General Instructions continued Nonperiodic payments 10 withholding Your payer must withhold at a default 10 rate from the taxable amount of nonperiodic payments unless you enter a different rate on line 2 Distributions from an IRA that are payable on demand are treated as nonperiodic payments

In the case that you are searching for a effective and basic method to improve your performance, look no further than printable design templates. These time-saving tools are free-and-easy to utilize, providing a range of advantages that can assist you get more carried out in less time.

Form 940 2024 Fillable

940 Pr 2021 Fill Online Printable Fillable Blank Form 940 pr

940 Pr 2021 Fill Online Printable Fillable Blank Form 940 pr

940 Pr 2021 Fill Online Printable Fillable Blank Form 940 pr

Form 940 2024 Fillable Printable templates can help you remain arranged. By supplying a clear structure for your tasks, to-do lists, and schedules, printable design templates make it simpler to keep everything in order. You'll never have to fret about missing due dates or forgetting essential jobs again. Using printable templates can assist you save time. By getting rid of the need to develop brand-new documents from scratch every time you require to finish a job or prepare an event, you can focus on the work itself, instead of the paperwork. Plus, many design templates are adjustable, allowing you to customize them to suit your needs. In addition to saving time and remaining arranged, using printable design templates can likewise assist you stay inspired. Seeing your development on paper can be a powerful incentive, encouraging you to keep working towards your goals even when things get hard. Overall, printable design templates are an excellent method to improve your efficiency without breaking the bank. Why not provide them a try today and begin accomplishing more in less time?

IRS 940 Schedule A 2010 Fill Out Tax Template Online US Legal Forms

Irs 940 schedule a 2010 fill out tax template online us legal forms

Irs 940 schedule a 2010 fill out tax template online us legal forms

In a move towards modernization the IRS is also planning to enable electronic filing of amended Form 940 via the Modernized e File MeF system starting in 2024 Changes in Form 941 Social Security Medicare and Payroll Tax Credits Image of Form 941 Social Security and Medicare Tax Rates for 2023

940 for 2023 Employer s Annual Federal Unemployment FUTA Tax Return Department of the Treasury Internal Revenue Service Employer identification number EIN Name not your trade name Trade name if any Address Number Street Suite or room number City State Foreign country name Foreign province county ZIP code Foreign postal code 850113

Fillable Schedule A Form 940 Multi State Employer And Credit Reduction Information 2017

Fillable schedule a form 940 multi state employer and credit reduction information 2017

Fillable schedule a form 940 multi state employer and credit reduction information 2017

Fillable Schedule R Form 940 Allocation Schedule For Aggregate Form 940 Filers Printable Pdf

Fillable schedule r form 940 allocation schedule for aggregate form 940 filers printable pdf

Fillable schedule r form 940 allocation schedule for aggregate form 940 filers printable pdf

Free printable templates can be an effective tool for boosting productivity and achieving your goals. By choosing the ideal templates, integrating them into your regimen, and individualizing them as required, you can enhance your day-to-day tasks and take advantage of your time. So why not give it a try and see how it works for you?

Form 940 and Schedule A Form 940 are due by January 31 2024 for tax year 2023 Employers subject to the FUTA credit reduction must pay these additional taxes with the filing of their Form 940

Form 940 is an IRS document filed by employers once a year to report their Federal Unemployment Tax Act FUTA tax liability Unlike other federal payroll taxes such as Medicare and Social Security FUTA taxes are only paid by the employer and not deducted from employees wages What is FUTA Tax