Form 4506 T

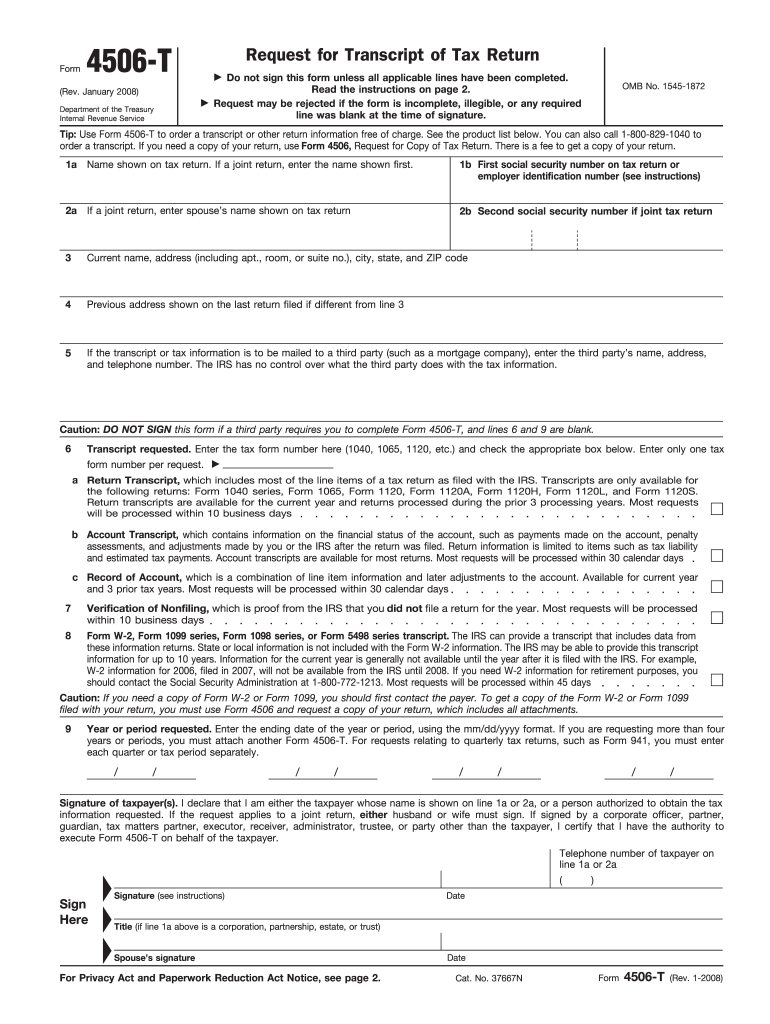

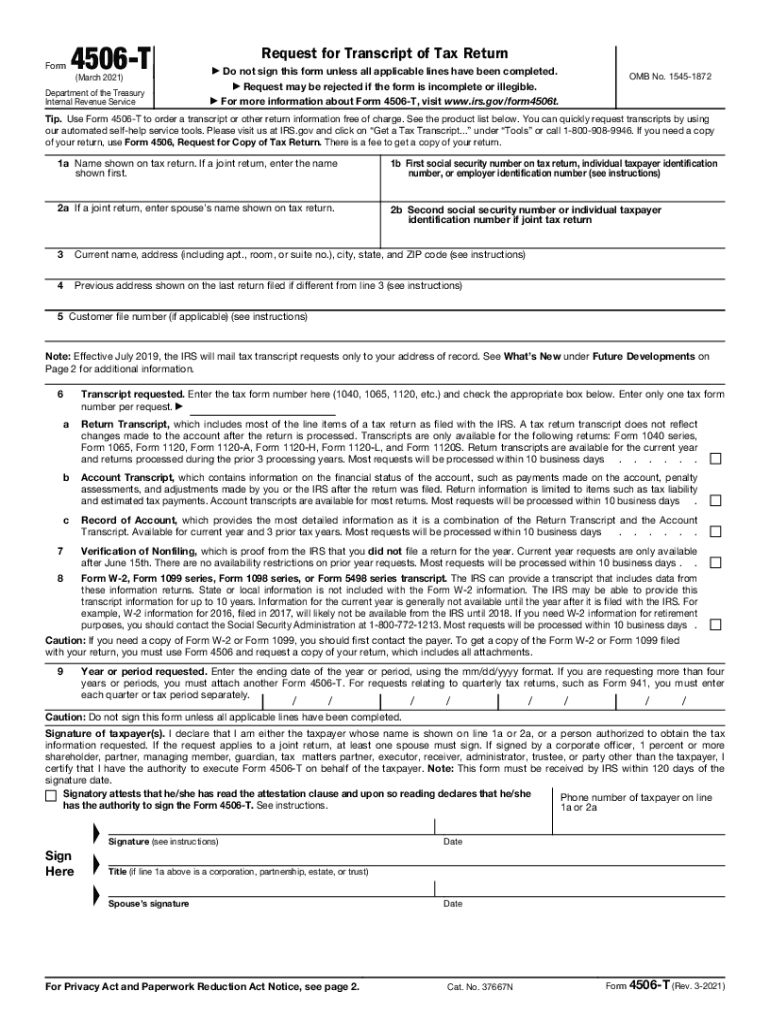

Form 4506 T - Web Mar 8 2023 nbsp 0183 32 Use Form 4506 T to request any of the transcripts tax return tax account wage and income record of account and verification of non filling The transcript format better protects taxpayer data by partially masking personally identifiable information Web 4506 T Request for Transcript of Tax Return Form Do not sign this form unless all applicable lines have been completed June 2023 OMB No 1545 1872 Request may be rejected if the form is incomplete Department of the Treasury or illegible Internal Revenue Service For more information about Form 4506 T visit www irs gov form4506t Web Mar 1 2019 nbsp 0183 32 IRS Form 4506 T COVID EIDL Disaster Request for Transcript of Tax Return This form gives permission for the IRS to provide SBA your tax return information when applying for COVID EIDL disaster loan assistance Tips for preparing your COVID EIDL 4506 T Download pdf File size 240KB Effective March 1 2019 Related Programs

Look no further than printable design templates in the case that you are looking for a basic and effective way to boost your efficiency. These time-saving tools are free-and-easy to utilize, supplying a series of advantages that can assist you get more performed in less time.

Form 4506 T

Form 4506 t Printable

Form 4506 t Printable

Form 4506 t Printable

Form 4506 T First of all, printable design templates can assist you remain arranged. By providing a clear structure for your jobs, to-do lists, and schedules, printable design templates make it much easier to keep whatever in order. You'll never ever need to stress over missing due dates or forgetting essential tasks again. Utilizing printable design templates can assist you conserve time. By eliminating the need to develop new files from scratch each time you need to complete a task or prepare an occasion, you can concentrate on the work itself, rather than the documents. Plus, many design templates are adjustable, allowing you to individualize them to match your needs. In addition to conserving time and remaining organized, utilizing printable design templates can also assist you stay motivated. Seeing your development on paper can be a powerful incentive, encouraging you to keep working towards your objectives even when things get difficult. Overall, printable design templates are a terrific way to improve your performance without breaking the bank. Why not provide them a shot today and begin accomplishing more in less time?

Printable Form 4506t Printable Forms Free Online

Printable form 4506t printable forms free online

Printable form 4506t printable forms free online

Web Mar 8 2023 nbsp 0183 32 This letter is available after June 15 for the current tax year or anytime for the prior three tax years using Get Transcript Online or Form 4506 T Use Form 4506 T if you need a letter for older tax years Note A transcript isn t a photocopy of your return

Web Jan 27 2023 nbsp 0183 32 Form 4506 is used by taxpayers to request copies of their tax returns for a fee Use Form 4506 to Request a copy of your tax return or Designate a third party to receive the tax return Current Revision Form 4506PDF

4506 T Fill Out Sign Online DocHub

4506 t fill out sign online dochub

4506 t fill out sign online dochub

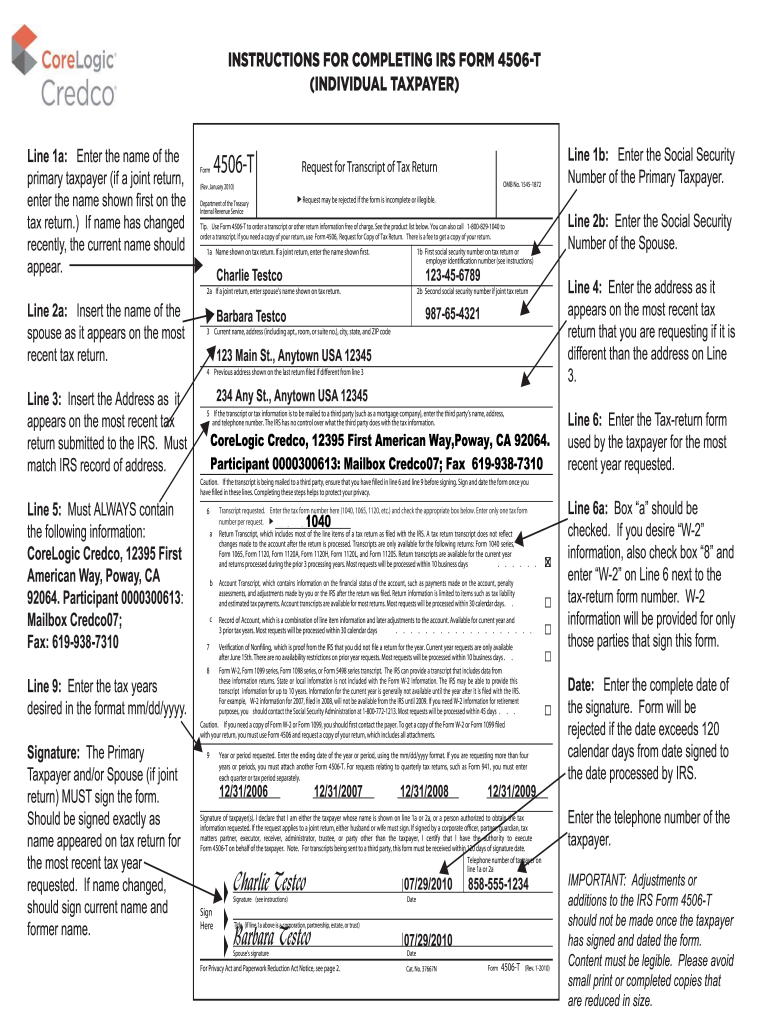

INSTRUCTIONS FOR COMPLETING IRS FORM 4506 T Fill Out Sign Online

Instructions for completing irs form 4506 t fill out sign online

Instructions for completing irs form 4506 t fill out sign online

Free printable templates can be a powerful tool for enhancing productivity and achieving your objectives. By picking the ideal templates, integrating them into your routine, and customizing them as needed, you can improve your day-to-day tasks and maximize your time. Why not provide it a shot and see how it works for you?

Web 4506 T March 2019 Department of the Treasury Internal Revenue Service Disaster Request for Transcript of Tax Return Do not sign this form unless all applicable lines have been completed OMB No 1545 1872 Request may be rejected if

Web Form 4506 T Rev 3 2019 sba gov The 4506T should be completed using your name and social security number SSN if you Step 3 Enter the address exactly as written on the 2019 Federal Tax Return Step 4 Enter your SBA loan application number file your business on a 1040 Schedule C E or F