What Is Revenue Recognition

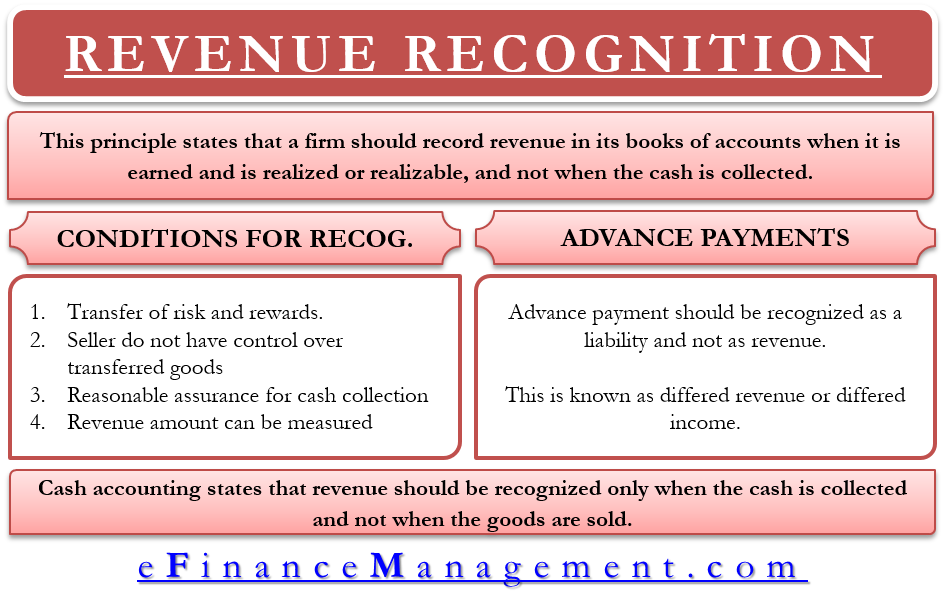

What Is Revenue Recognition - Web Sep 26 2019 nbsp 0183 32 Revenue recognition is an accounting principle that outlines the specific conditions under which revenue is recognized In theory there is a wide range of potential points at which revenue can be recognized This guide addresses recognition principles for both IFRS and U S GAAP Web The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle They both determine the accounting period in which revenues and expenses are recognized Web Mar 30 2022 nbsp 0183 32 Revenue recognition means recording when your business has actually earned its revenue and that s where it starts to get complicated If your business uses the cash basis of accounting revenue recognition is easy you earn your revenue when the cash hits your cash register or bank account

Look no further than printable templates in the case that you are looking for a efficient and easy method to increase your productivity. These time-saving tools are free-and-easy to utilize, offering a series of benefits that can help you get more done in less time.

What Is Revenue Recognition

What Is The Revenue Recognition Principle

What Is The Revenue Recognition Principle

What Is Revenue Recognition Printable design templates can assist you remain arranged. By providing a clear structure for your jobs, order of business, and schedules, printable design templates make it much easier to keep whatever in order. You'll never ever have to stress over missing out on due dates or forgetting essential tasks again. Second of all, using printable design templates can help you save time. By getting rid of the requirement to create new files from scratch every time you need to complete a task or prepare an occasion, you can concentrate on the work itself, rather than the documents. Plus, many design templates are customizable, permitting you to individualize them to suit your requirements. In addition to conserving time and remaining organized, utilizing printable templates can likewise assist you remain inspired. Seeing your development on paper can be an effective motivator, motivating you to keep working towards your goals even when things get hard. Overall, printable templates are a terrific method to improve your efficiency without breaking the bank. Why not give them a try today and begin accomplishing more in less time?

Revenue Recognition Principle In TWO MINUTES YouTube

Revenue recognition principle in two minutes youtube

Revenue recognition principle in two minutes youtube

Web Revenue recognition methods under ASC 606 should cover criteria timing and other core aspects of contract revenue recognition Our roadmap can help you manage this process We lay out the five step revenue recognition process plus some significant judgments you may need to make along the way

Web REVENUE RECOGNITION WHY DID THE FASB ISSUE A NEW STANDARD ON REVENUE RECOGNITION Revenue is one of the most important measures used by investors in assessing a company s performance and prospects

Revenue Recognition Principles Criteria For Recognizing Revenues

Revenue recognition principles criteria for recognizing revenues

Revenue recognition principles criteria for recognizing revenues

Revenue Recognition Principle Class 11 REVNEUS

Revenue recognition principle class 11 revneus

Revenue recognition principle class 11 revneus

Free printable templates can be a powerful tool for increasing productivity and achieving your objectives. By picking the right templates, integrating them into your regimen, and individualizing them as required, you can streamline your everyday jobs and maximize your time. So why not give it a try and see how it works for you?

Web May 26 2023 nbsp 0183 32 What is revenue recognition Revenue recognition is a principle that refers to how a business recognizes its revenue Revenue recognition is an important part of GAAP or generally accepted accounting principles It also has to do with the way a business accounts for its revenue

Web Sep 19 2022 nbsp 0183 32 Revenue recognition is an accounting principle that asserts that revenue must be recognized as it is earned So the question becomes when is revenue considered earned by a company Revenue is generally recognized after a critical event occurs like the product being delivered to the customer