Section 179

Section 179 - Section 179 of the United States Internal Revenue Code 26 U S C 167 179 allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense Section 179 is an attractive tax deduction for small and medium businesses and it s easy to understand and utilize How much money can Section 179 save you in 2025 This calculator Sep 17 2024 nbsp 0183 32 Section 179 of the U S Internal Revenue Code allows businesses to deduct the cost of depreciable assets such as equipment vehicles and software immediately rather than

Whenever you are looking for a effective and basic method to enhance your efficiency, look no further than printable design templates. These time-saving tools are simple and free to utilize, offering a variety of benefits that can help you get more carried out in less time.

Section 179

Section 179 Definition How It Works And Example 55 OFF

Section 179 Definition How It Works And Example 55 OFF

Section 179 Definition How It Works And Example 55 OFF

Section 179 Printable templates can assist you stay organized. By offering a clear structure for your tasks, order of business, and schedules, printable design templates make it much easier to keep whatever in order. You'll never have to fret about missing out on due dates or forgetting crucial jobs once again. Second of all, using printable templates can help you conserve time. By eliminating the need to create brand-new documents from scratch whenever you need to finish a task or plan an event, you can focus on the work itself, rather than the documentation. Plus, numerous templates are personalized, permitting you to individualize them to fit your needs. In addition to conserving time and remaining arranged, utilizing printable templates can likewise assist you remain inspired. Seeing your development on paper can be an effective incentive, encouraging you to keep working towards your goals even when things get tough. Overall, printable design templates are an excellent method to improve your efficiency without breaking the bank. Why not give them a try today and start accomplishing more in less time?

Section 179 simplified

Section 179 simplified

Section 179 simplified

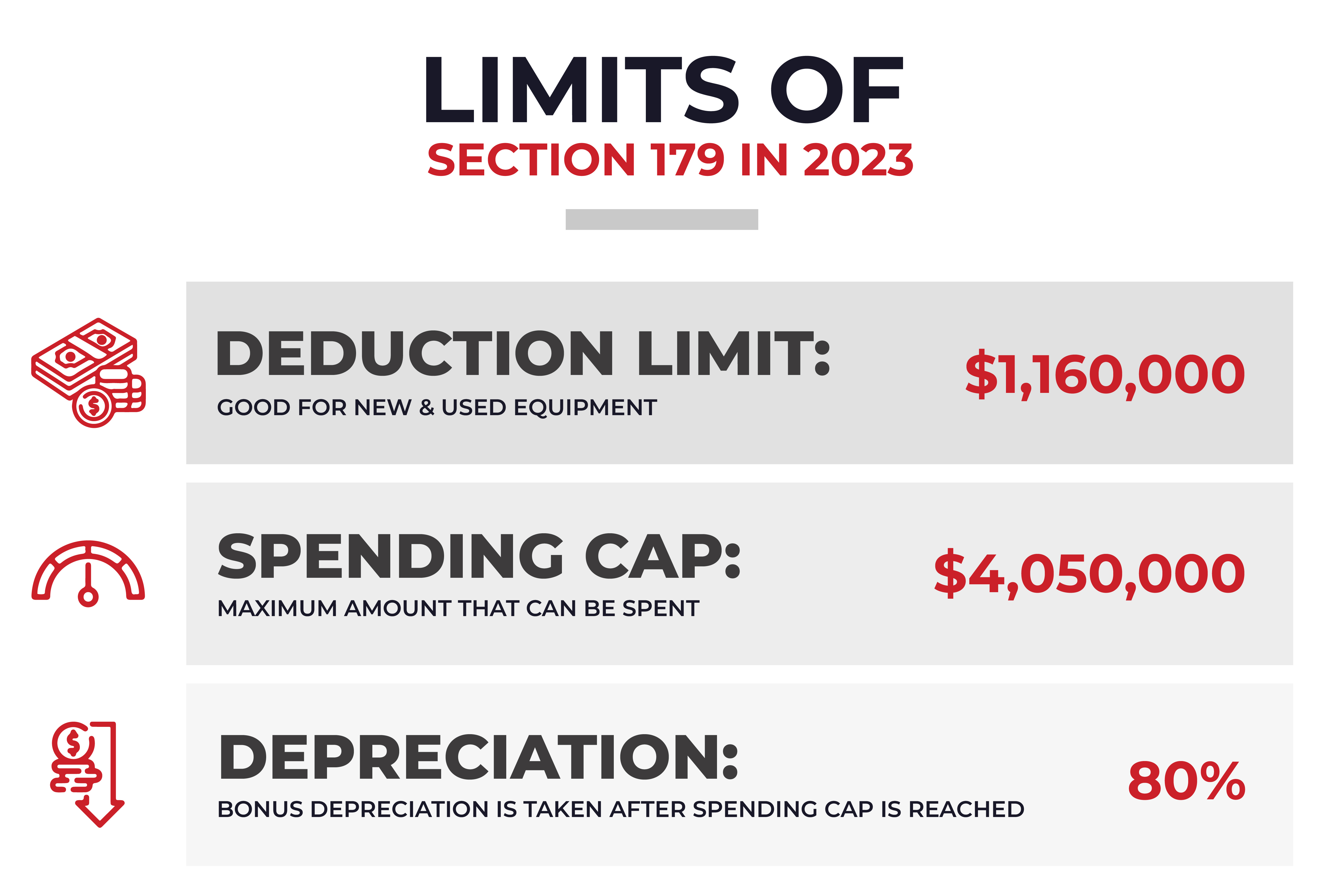

Jul 4 2025 nbsp 0183 32 The Section 179 deduction limit is 2 500 000 in 2025 and 4 000 000 in 2026 It lets businesses deduct the cost of some assets immediately rather than over time

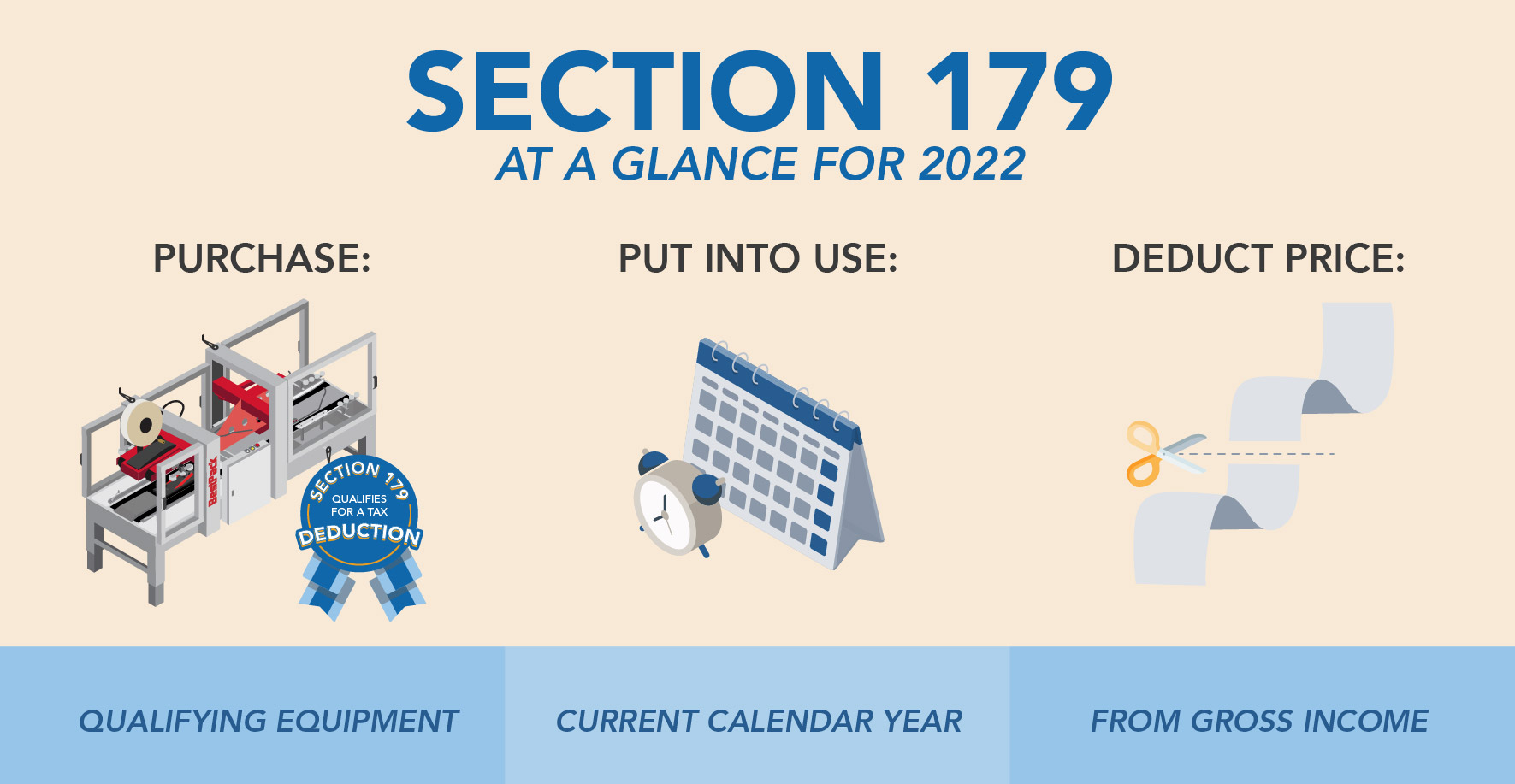

Section 179 of the Internal Revenue Code provides an accelerated depreciation method that enables businesses to deduct the cost of tangible assets in the same tax year they are

Section 179 In 2022 BestPack 43 OFF Www micoope gt

Section 179 in 2022 bestpack 43 off www micoope gt

Section 179 in 2022 bestpack 43 off www micoope gt

Section 179 Deduction 2024 2025

Section 179 deduction 2024 2025

Section 179 deduction 2024 2025

Free printable design templates can be a powerful tool for increasing efficiency and attaining your goals. By picking the ideal templates, including them into your regimen, and individualizing them as required, you can improve your day-to-day jobs and maximize your time. Why not give it a try and see how it works for you?

Feb 8 2024 nbsp 0183 32 Section 179 is a federal rule intended to help small and medium sized businesses by allowing them to receive specific tax benefits sooner if they choose to do so If you purchase

Aug 29 2024 nbsp 0183 32 The IRS Section 179 deduction lets business owners deduct the full amount of the cost of qualifying new and used machinery furniture vehicles and certain improvement