Schedule A Form 940 For 2022

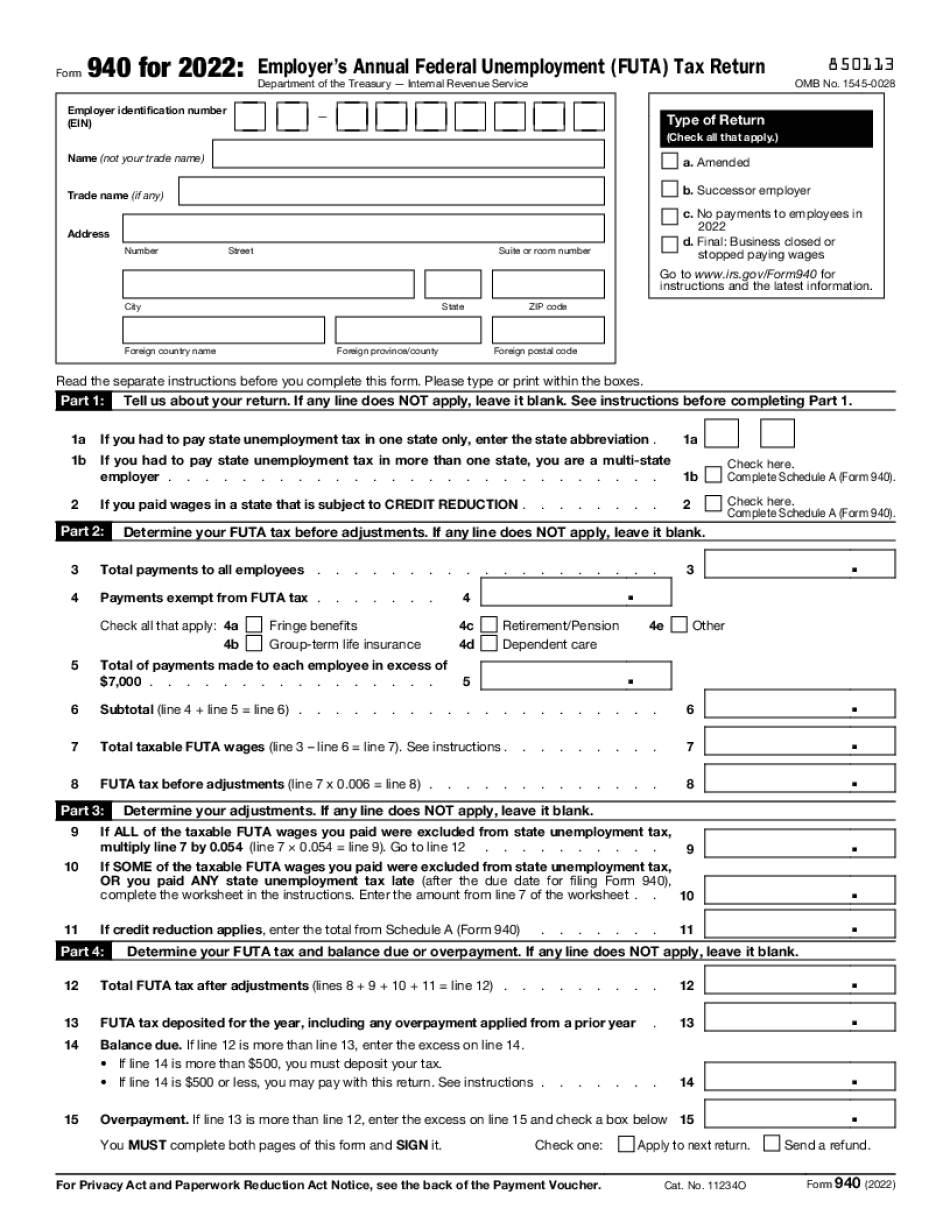

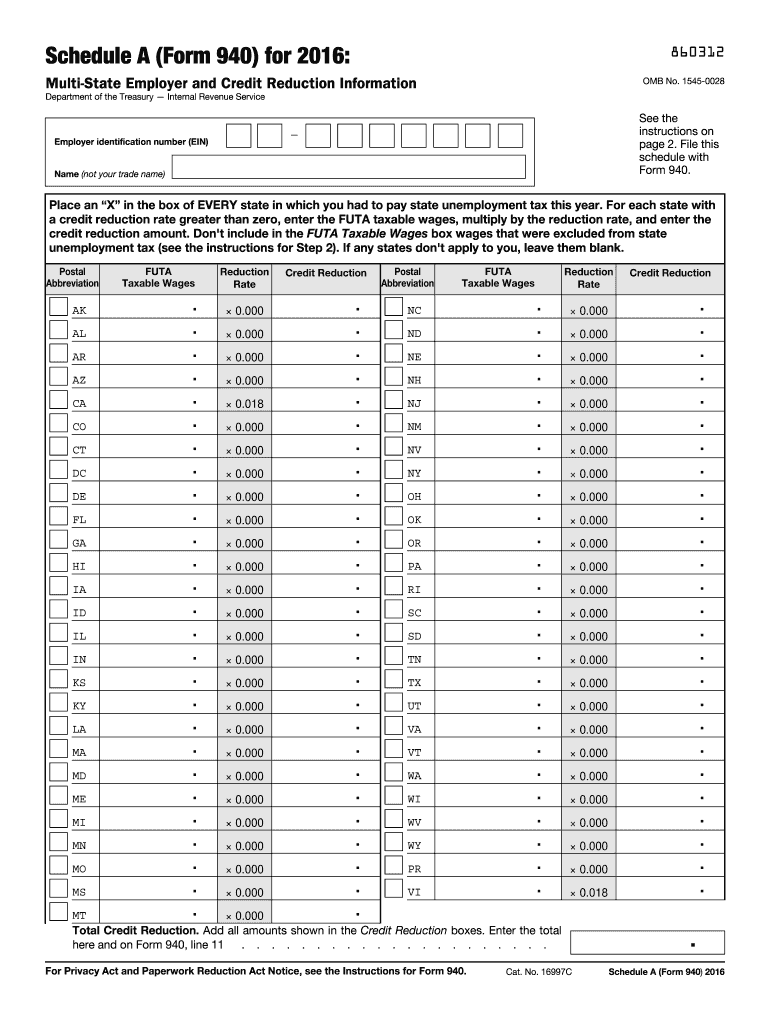

Schedule A Form 940 For 2022 - Web Complete Schedule A Form 940 2 If you paid wages in a state that is subject to CREDIT REDUCTION 2 Part 2 Determine your FUTA tax before adjustments If any line does NOT apply leave it blank Check here Web Dec 2 2022 nbsp 0183 32 IRS Releases 2022 Form 940 Schedule A BY Curtis E Tatum Esq 12 02 22 The IRS has released the 2022 Form 940 Employer s Annual Federal Unemployment FUTA Tax Return Schedule A Form 940 Multi State Employer and Credit Reduction Information and the Instructions for Form 940 Four States and Virgin Web Sep 21 2022 nbsp 0183 32 Use Schedule A Form 940 to figure your annual Federal Unemployment Tax Act FUTA tax for states that have a credit reduction on wages that are subject to the unemployment compensation laws About Schedule A Form 940 Multi State Employer and Credit Reduction Information Internal Revenue Service

Look no even more than printable design templates in case that you are looking for a effective and simple way to increase your productivity. These time-saving tools are easy and free to use, supplying a series of advantages that can assist you get more done in less time.

Schedule A Form 940 For 2022

940 Schedule A 2023 Fill Online Printable Fillable Blank

940 Schedule A 2023 Fill Online Printable Fillable Blank

940 Schedule A 2023 Fill Online Printable Fillable Blank

Schedule A Form 940 For 2022 To start with, printable templates can help you remain organized. By supplying a clear structure for your jobs, order of business, and schedules, printable templates make it easier to keep everything in order. You'll never have to fret about missing out on due dates or forgetting essential jobs again. Second of all, utilizing printable templates can help you save time. By getting rid of the need to create brand-new files from scratch whenever you need to complete a job or plan an occasion, you can concentrate on the work itself, rather than the documentation. Plus, numerous templates are customizable, enabling you to personalize them to match your needs. In addition to conserving time and remaining organized, using printable design templates can also assist you stay encouraged. Seeing your progress on paper can be a powerful incentive, motivating you to keep working towards your objectives even when things get hard. Overall, printable design templates are a great method to boost your efficiency without breaking the bank. So why not give them a shot today and begin achieving more in less time?

Fillable Form 940 Schedule A Printable Forms Free Online

Fillable form 940 schedule a printable forms free online

Fillable form 940 schedule a printable forms free online

Web For tax year 2022 there are credit reduction states If you paid wages subject to the unemployment tax laws of these states check the box on line 2 and fill out Schedule A Form 940 See the instructions for line 9 before completing the Schedule A Form 940

Web Jan 7 2023 nbsp 0183 32 Updated on January 7 2023 10 30 AM by Admin TaxBandits Employers use Schedule A Form 940 when required to pay state unemployment tax in more than one state or if the paid wages in any state are subject to credit reduction This form must be attached to the Form 940 when filed

940 Form 2016 Fill Out And Sign Printable PDF Template SignNow

940 form 2016 fill out and sign printable pdf template signnow

940 form 2016 fill out and sign printable pdf template signnow

IRS Releases 2022 Form 940 And Schedule A

Irs releases 2022 form 940 and schedule a

Irs releases 2022 form 940 and schedule a

Free printable design templates can be a powerful tool for boosting performance and attaining your objectives. By choosing the right templates, incorporating them into your regimen, and customizing them as needed, you can enhance your daily tasks and take advantage of your time. So why not give it a try and see how it works for you?

Web Aug 8 2023 nbsp 0183 32 Agricultural workers farmworkers test If you re an agricultural employer you ll need to pay FUTA tax if you meet either of the following two conditions You ve paid cash wages of at least

Web June 8 2023 183 5 minute read The revised drafts of Form 940 Employer s Annual Federal Unemployment FUTA Tax Return and Form 940 Schedule A Multi State Employer and Credit Reduction Information released by the IRS reflect a forecast of increased credit reduction rates for California Connecticut Illinois New York and the Virgin Islands