Primary And Secondary Market

Primary And Secondary Market - Web May 28 2022 nbsp 0183 32 In a primary market it s the issuer of the shares or bonds or whatever the asset is In a secondary market it s another investor or owner When you buy a security on the primary market Web Relation to Shares The primary market is where new shares are sold for the first time whereas the secondary market allows investors to trade previously issued securities between themselves Nature of Transaction On the primary market investors buy securities directly from issuers at the IPO Web Source Difference Between Primary and Secondary Market wallstreetmojo Key Differences In the primary market investors can purchase the shares directly from the company In contrast they cannot do so in the secondary market as shares are now being traded among investors themselves

Look no further than printable templates whenever you are looking for a effective and basic way to enhance your performance. These time-saving tools are simple and free to utilize, supplying a range of advantages that can help you get more performed in less time.

Primary And Secondary Market

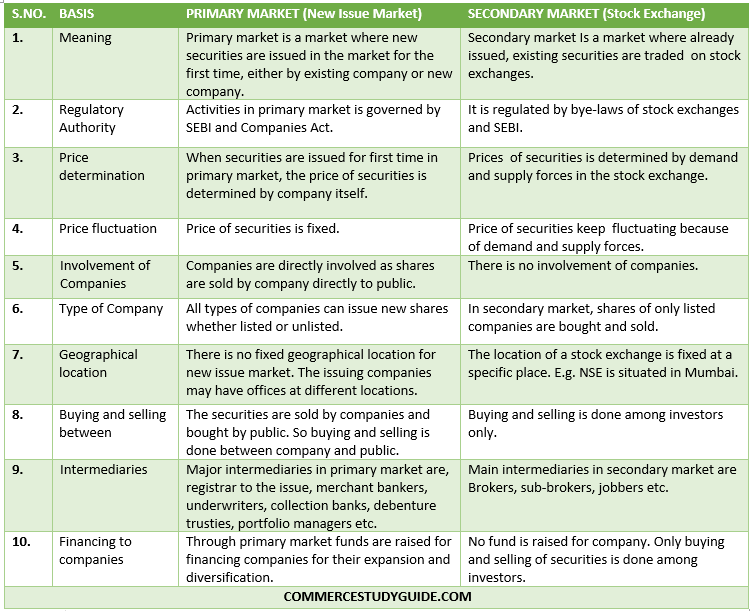

Primary Market Vs Secondary Market 10 Differences With Infographics

Primary Market Vs Secondary Market 10 Differences With Infographics

Primary Market Vs Secondary Market 10 Differences With Infographics

Primary And Secondary Market Firstly, printable design templates can assist you stay arranged. By providing a clear structure for your jobs, order of business, and schedules, printable templates make it simpler to keep everything in order. You'll never ever have to stress over missing deadlines or forgetting essential tasks again. Using printable design templates can help you conserve time. By getting rid of the requirement to develop new documents from scratch whenever you need to finish a job or plan an occasion, you can focus on the work itself, rather than the paperwork. Plus, numerous templates are adjustable, allowing you to personalize them to fit your requirements. In addition to saving time and staying arranged, utilizing printable templates can likewise help you remain encouraged. Seeing your progress on paper can be an effective motivator, motivating you to keep working towards your objectives even when things get difficult. Overall, printable templates are an excellent way to increase your performance without breaking the bank. So why not provide a try today and begin accomplishing more in less time?

Difference Between Primary Market And Secondary Market Primary Vs

Difference between primary market and secondary market primary vs

Difference between primary market and secondary market primary vs

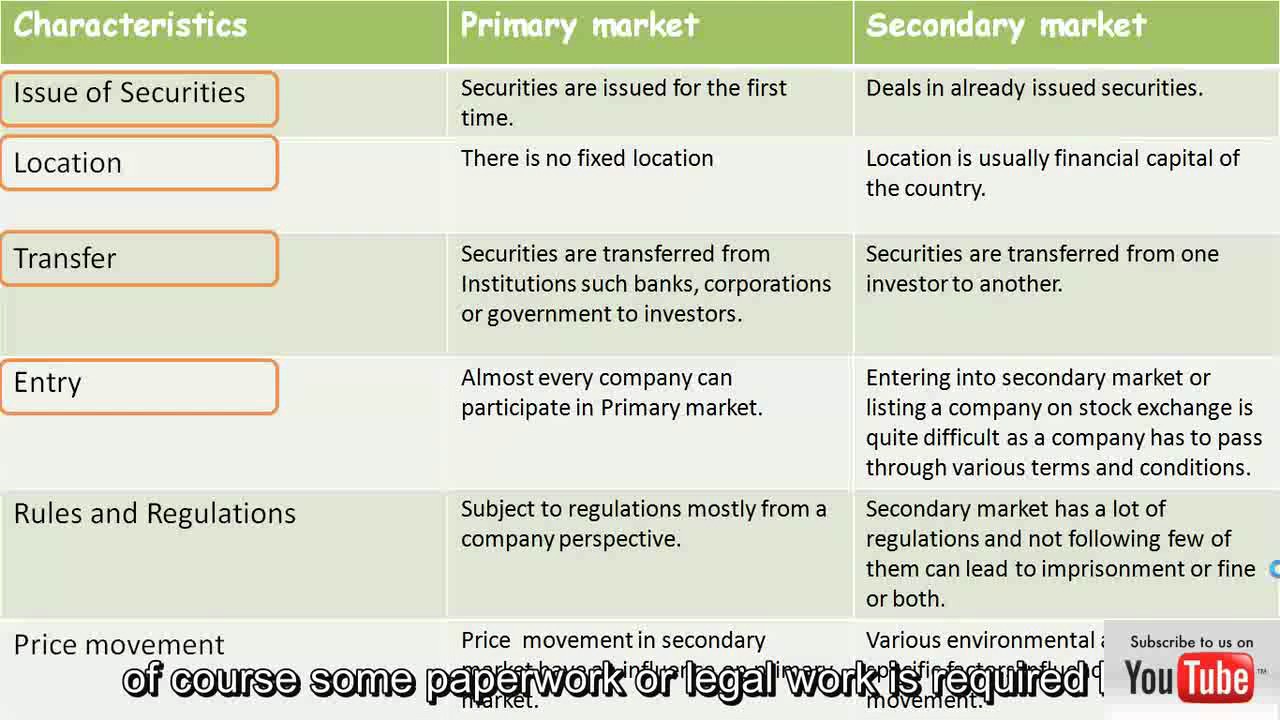

Web Nov 12 2023 nbsp 0183 32 Primary and secondary markets and all markets really help people and entities set prices for stocks sweaters and all assets in between Together primary and secondary markets serve an important role in the price discovery process and are essential for the proper functioning of capital markets

Web Nov 19 2018 nbsp 0183 32 The prices in the primary market are fixed while the prices vary in the secondary market depending upon the demand and supply of the securities traded Primary market provides financing to new companies and also to old companies for their expansion and diversification

What Is The Primary Market And Secondary Market Secondary Market

what is the primary market and secondary market secondary market

what is the primary market and secondary market secondary market

Difference Between Primary And Secondary Market 5 Points Important

Difference between primary and secondary market 5 points important

Difference between primary and secondary market 5 points important

Free printable design templates can be a powerful tool for improving performance and accomplishing your objectives. By picking the ideal templates, integrating them into your regimen, and personalizing them as required, you can enhance your daily tasks and take advantage of your time. Why not offer it a try and see how it works for you?

Web Jul 24 2023 nbsp 0183 32 The secondary market is where securities are traded after the company has sold its offering on the primary market It is also referred to as the stock market The New York Stock Exchange

Web The main difference between Primary and Secondary market is that in the former the investors buy securities directly from the company issuing them while in latter investors trade securities among themselves