Form 3115 Instructions 2022

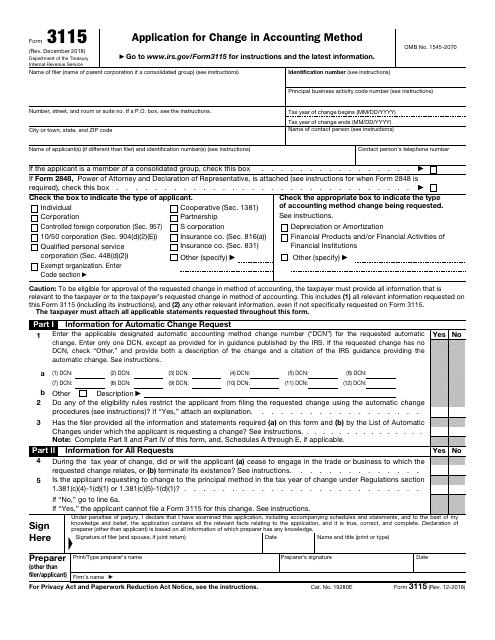

Form 3115 Instructions 2022 - Web Jul 26 2023 nbsp 0183 32 Information about Form 3115 Application for Change in Accounting Method including recent updates related forms and instructions on how to file File this form to request a change in either About Form 3115 Application for Change in Accounting Method Internal Revenue Service Web Form 3115 Rev December 2022 Department of the Treasury Internal Revenue Service Application for Change in Accounting Method Go to www irs gov Form3115 for instructions and the latest information OMB No 1545 2070 Attachment Sequence No 315 Name of filer name of parent corporation if a consolidated group see instructions Web April 7 2023 10 07 AM IRS Issues Revised Form 3115 for Changes in Accounting Methods Michael Rapoport Senior Reporter Bloomberg Tax The IRS has issued a revised version of the form and instructions that taxpayers use to apply for changes in accounting methods incorporating a variety of changes that the agency has made in recent years

In case that you are looking for a simple and efficient way to boost your performance, look no more than printable design templates. These time-saving tools are free-and-easy to utilize, supplying a range of advantages that can assist you get more carried out in less time.

Form 3115 Instructions 2022

Form 3115 Instructions Application For Change In Accounting Method

Form 3115 Instructions Application For Change In Accounting Method

Form 3115 Instructions Application For Change In Accounting Method

Form 3115 Instructions 2022 Printable templates can help you remain arranged. By providing a clear structure for your jobs, order of business, and schedules, printable design templates make it easier to keep whatever in order. You'll never have to stress over missing out on due dates or forgetting essential tasks again. Secondly, using printable templates can assist you save time. By eliminating the need to create brand-new files from scratch every time you need to complete a task or prepare an occasion, you can focus on the work itself, instead of the documents. Plus, numerous design templates are personalized, permitting you to individualize them to fit your needs. In addition to saving time and remaining organized, utilizing printable design templates can also assist you remain inspired. Seeing your development on paper can be a powerful motivator, encouraging you to keep working towards your goals even when things get tough. Overall, printable templates are an excellent way to improve your performance without breaking the bank. So why not provide a try today and start attaining more in less time?

Form 3115 Instructions Application For Change In Accounting Method

Form 3115 instructions application for change in accounting method

Form 3115 instructions application for change in accounting method

Web Announcement 2023 12 The Internal Revenue Service IRS has revised Form 3115 Application for Change in Accounting Method and its instructions The Form 3115 Rev December 2022 is the current Form 3115 December 2022 Form 3115 and replaces the December 2018 version of the Form 3115 December 2018 Form 3115

Web Revenue Procedure 2022 14 also has rules for Forms 3115 filed for accounting method changes that can no longer be made under the automatic change procedures and a transition rule for taxpayers that properly filed a duplicate copy of Form 3115 before January 31 2022 for an accounting method change that still qualifies under the automatic

Form 3115 Application For Change In Accounting Method 2015 Free Download

Form 3115 application for change in accounting method 2015 free download

Form 3115 application for change in accounting method 2015 free download

Form 3115 Applying A Cost Segregation Study On A Tax Return The

Form 3115 applying a cost segregation study on a tax return the

Form 3115 applying a cost segregation study on a tax return the

Free printable design templates can be an effective tool for improving performance and achieving your objectives. By selecting the best design templates, integrating them into your regimen, and customizing them as required, you can enhance your everyday jobs and make the most of your time. So why not give it a try and see how it works for you?

Web 11 Near the completion of processing the Form 3115 advises the taxpayer if the Associate office will rule adversely and offers the taxpayer the opportunity to withdraw Form 3115 55 12 Non automatic Form 3115 may be withdrawn or Associate office may decline to issue a change in method of accounting letter ruling 56 1 In general 56

Web Oct 26 2022 nbsp 0183 32 Affected taxpayers that have not implemented the final revenue recognition regulations or have taken a position contrary to the rules should act quickly to review their methods of accounting and file any necessary accounting method changes Form 3115 because the final rules are now mandatory for all covered income items with the