Completed Form 3115 Example

Completed Form 3115 Example - Web Sep 20 2021 nbsp 0183 32 Example filled in Form 3115 and other tax return forms provided for reference Depreciation adjustments and catch up calculations discussed with examples provided This blog post is designed as an example on how to apply a cost segregation study on a tax return Web Jul 26 2023 nbsp 0183 32 Information about Form 3115 Application for Change in Accounting Method including recent updates related forms and instructions on how to file File this form to request a change in either About Form 3115 Application for Change in Accounting Method Internal Revenue Service Web May 1 2019 nbsp 0183 32 For example a taxpayer with accounts receivables of 2 0MM and accounts payable of 1 0MM would obtain a negative 167 481 a adjustment which is a tax deduction in the year the IRS Form 3115 was properly filed for the taxpayer employing DCN 233

If ever you are trying to find a basic and effective way to enhance your performance, look no more than printable templates. These time-saving tools are free and easy to use, supplying a variety of benefits that can assist you get more carried out in less time.

Completed Form 3115 Example

Form 3115 Application For Change In Accounting Method 2015 Free Download

Form 3115 Application For Change In Accounting Method 2015 Free Download

Form 3115 Application For Change In Accounting Method 2015 Free Download

Completed Form 3115 Example Printable templates can help you remain organized. By supplying a clear structure for your jobs, order of business, and schedules, printable templates make it simpler to keep whatever in order. You'll never ever need to stress over missing due dates or forgetting essential tasks again. Using printable templates can assist you save time. By eliminating the need to create brand-new files from scratch whenever you need to finish a job or plan an event, you can concentrate on the work itself, instead of the documents. Plus, numerous templates are adjustable, allowing you to individualize them to match your needs. In addition to conserving time and remaining organized, utilizing printable templates can likewise assist you stay encouraged. Seeing your development on paper can be an effective incentive, encouraging you to keep working towards your objectives even when things get tough. Overall, printable design templates are a fantastic way to increase your performance without breaking the bank. Why not give them a try today and begin accomplishing more in less time?

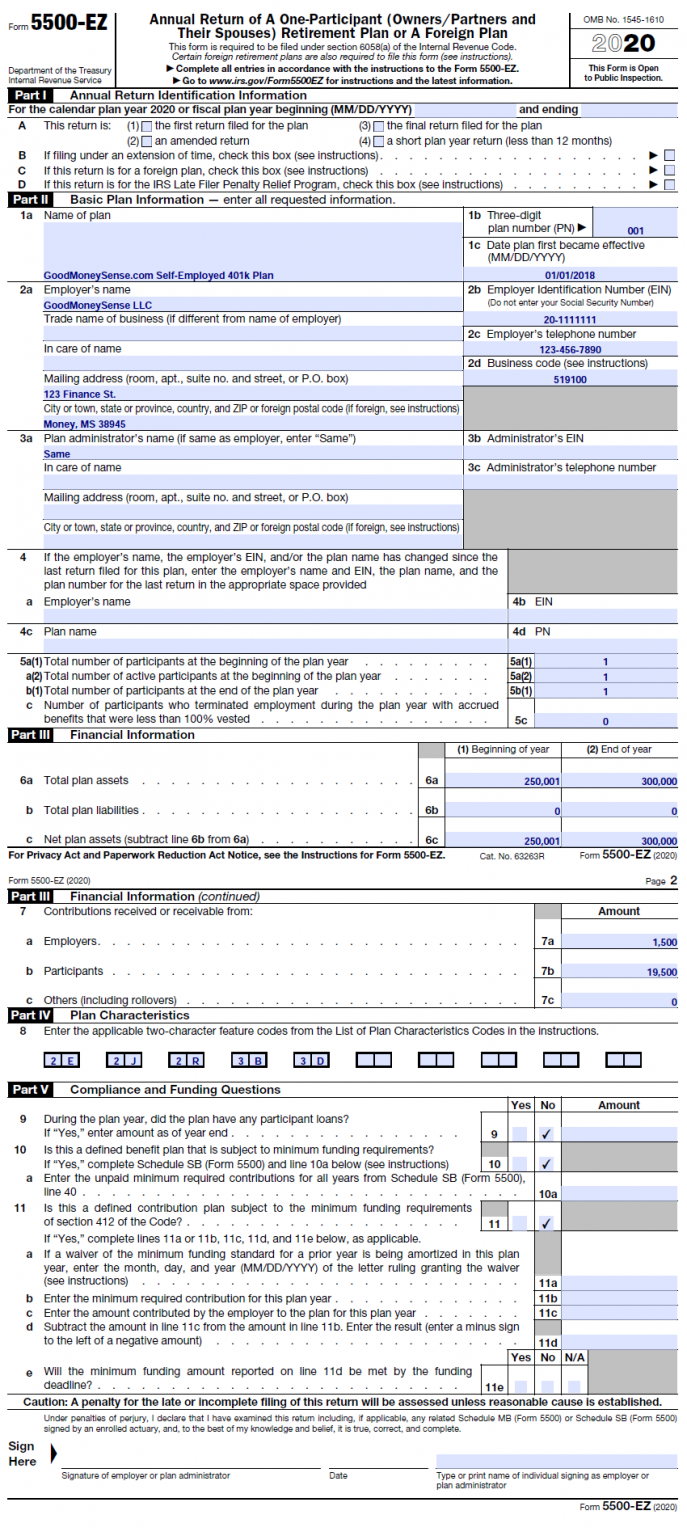

How To File The Form 5500 EZ For Your Solo 401k In 2021 Good Money Sense

How to file the form 5500 ez for your solo 401k in 2021 good money sense

How to file the form 5500 ez for your solo 401k in 2021 good money sense

Web Oct 13 2021 nbsp 0183 32 0 00 1 12 Webinar preview Completing Form 3115 Changing Accounting Methods National Association of Tax Professionals NATP 1 62K subscribers Subscribe 11 Share 2 3K views 1 year ago

Web Apr 15 2023 nbsp 0183 32 Completing Form 3115 Application for Change in Accounting Method Customer Support Updated 5 months ago Page 1 You must mark this form as either Business or Individual If you mark the Individual box you must enter T for the taxpayer S for the spouse or J for a joint return

Correcting Missed Rental Depreciation Attiyya S Ingram AFC

Correcting missed rental depreciation attiyya s ingram afc

Correcting missed rental depreciation attiyya s ingram afc

Form 3115 Edit Fill Sign Online Handypdf

Form 3115 edit fill sign online handypdf

Form 3115 edit fill sign online handypdf

Free printable design templates can be an effective tool for increasing productivity and achieving your goals. By selecting the best templates, incorporating them into your regimen, and personalizing them as required, you can enhance your daily jobs and make the most of your time. Why not provide it a try and see how it works for you?

Web Cat No 19280E Form 3115 Rev 12 2003 Signature see instructions Under penalties of perjury I declare that I have examined this application including accompanying schedules and statements and to the best of my knowledge and belief the application contains all the relevant facts relating to the application and it is true correct and

Web Need a completed Form 3115 example Was looking at the example of completed form 3115 attached to the response from quot InfoTaxes quot and was very excited to see the example However the form was revised in 2009 I need an example of a completed for 3115 to correct for depreciation not previously taken on a rental property using the current Form