Living in Colorado Springs and need to know the printable tax rate for the area? Look no further! Understanding the tax rates in your area is crucial for budgeting and financial planning. Let’s dive into the details.

Colorado Springs has a sales tax rate of 8.25%, which is composed of a 2.9% state sales tax, a 1.23% El Paso County sales tax, and a 4.12% Colorado Springs sales tax. This rate applies to most goods and services sold in the city.

Printable Tax Rate For Colorado Springs

Printable Tax Rate For Colorado Springs

Property tax rates in Colorado Springs vary depending on the county and city. Generally, the property tax rate is around 0.5% to 1% of the property’s assessed value. It’s essential to check with the local assessor’s office for specific rates.

Income tax rates in Colorado Springs range from 4.55% to 7.2%, depending on your income bracket. It’s essential to consult with a tax professional or use online tax calculators to determine your exact tax rate based on your income.

Overall, understanding the printable tax rates for Colorado Springs is crucial for managing your finances effectively. By knowing the sales tax, property tax, and income tax rates, you can better plan your budget and make informed financial decisions.

Now that you have a better understanding of the printable tax rates for Colorado Springs, you can confidently navigate your financial responsibilities in the area. Remember to stay informed about any changes in tax laws and seek professional advice when needed to ensure compliance and financial stability.

Colorado Income Tax Fill Out Sign Online DocHub

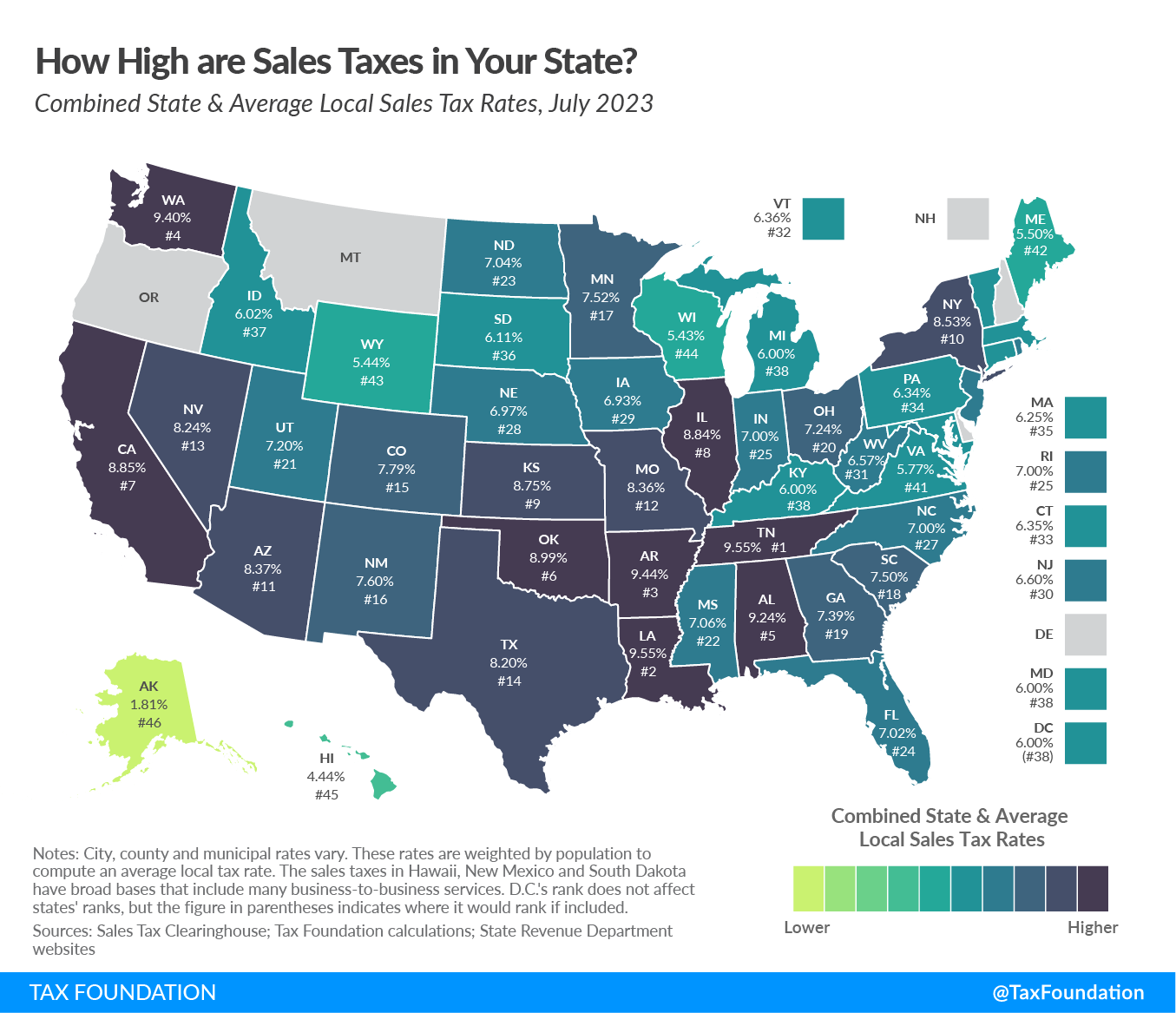

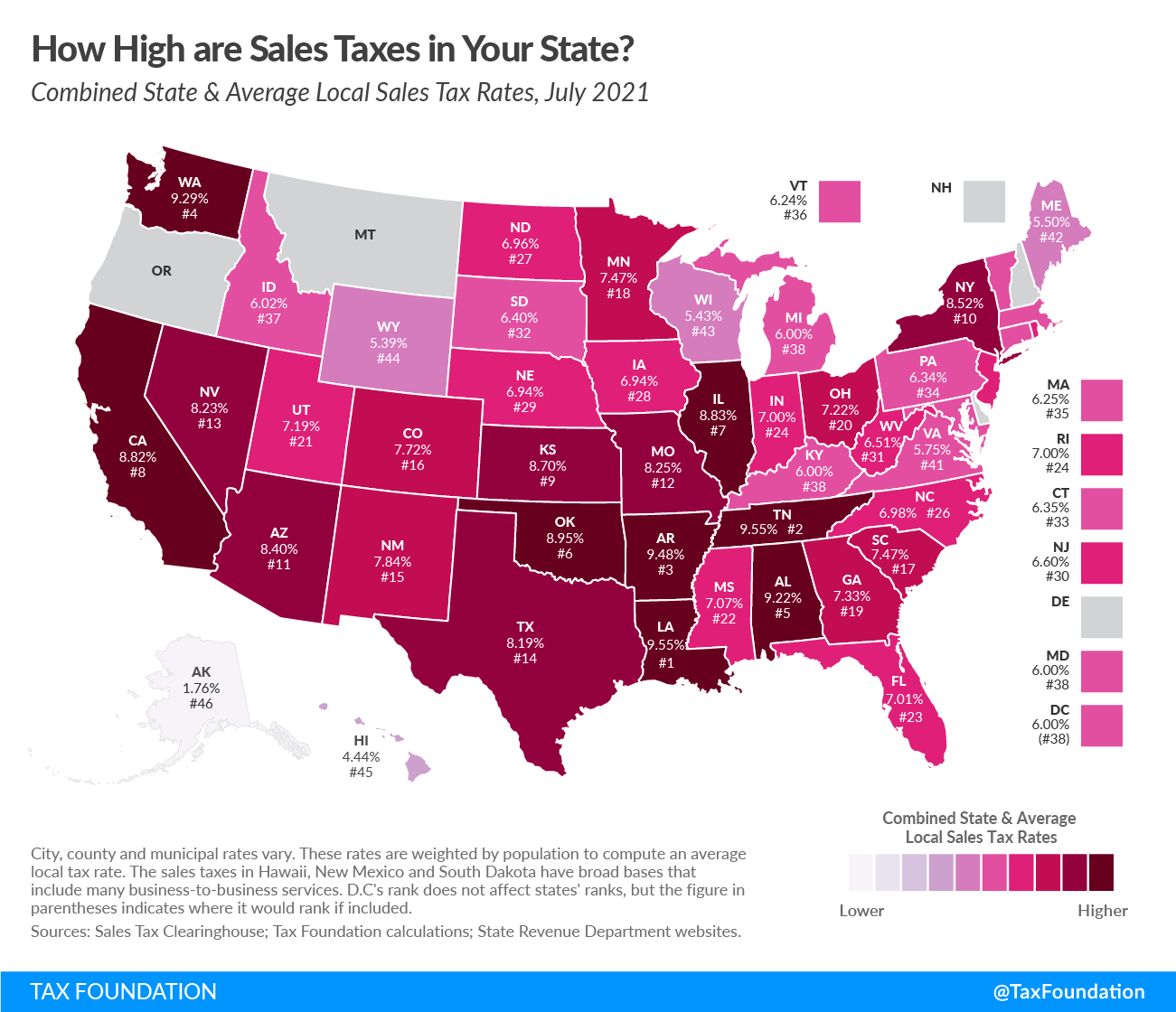

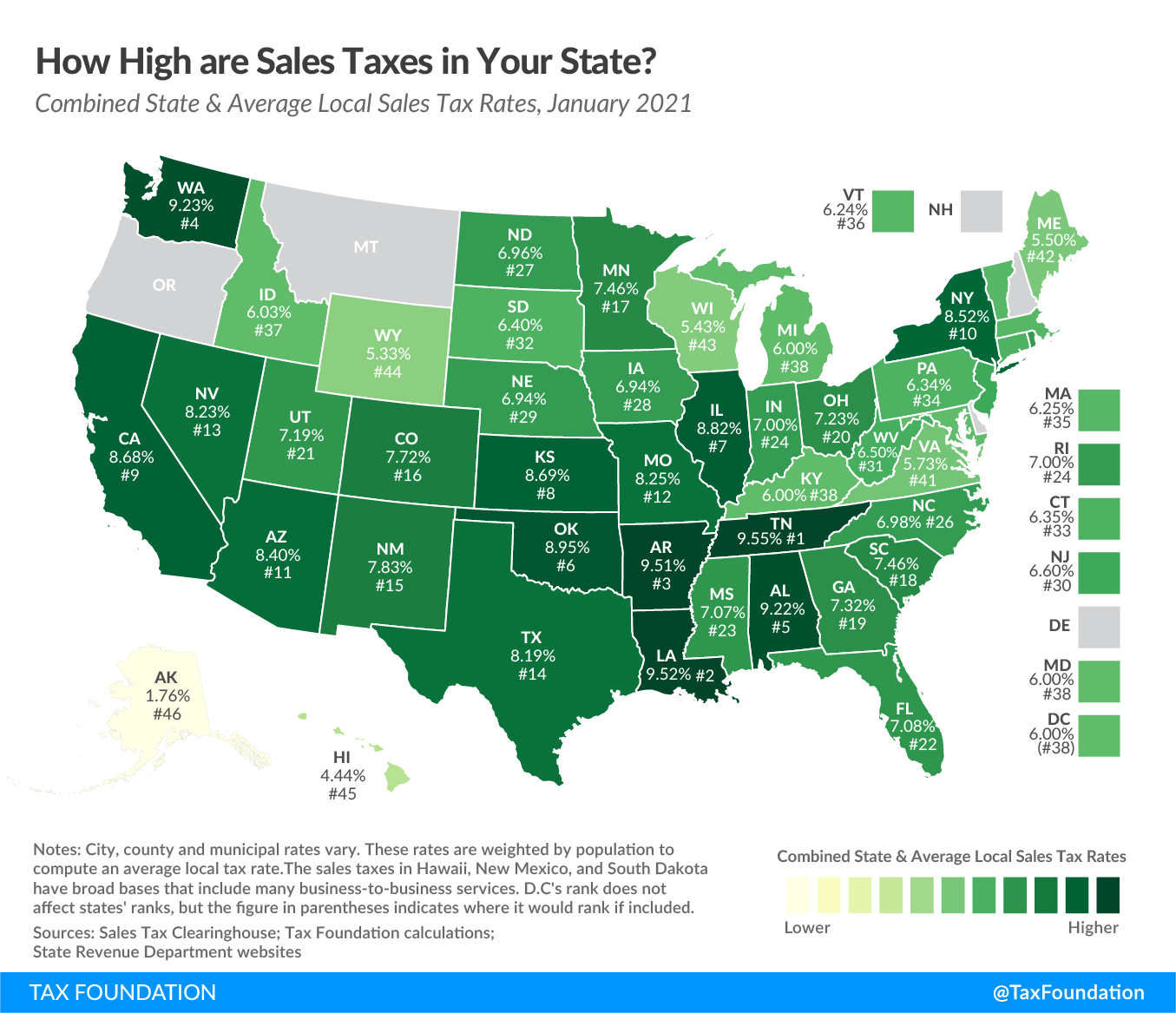

2025 Sales Tax Rates Sales Taxes By State

2025 Sales Tax Rates Sales Taxes By State

2025 Sales Tax Rates Sales Taxes By State

Colorado 2025 Sales Tax Guide